0x1c8c5b6a

- 4 de julio de 2025

- Sin categorizar

0x1c8c5b6a

Leer más

The steps taken by a business operative to make sure that the day-to-day working capital of their business entity is favorable for the cost of operations can be referred to as working capital management. If you are an up-and-coming business owner or an entrepreneur, this article will help you get familiar with two of the most important concepts in shaping the finance model of your business venture. Both the concepts of working capital have their own points of importance.

This reduces current liabilities because the debts are no longer due within a year. Analysts and lenders use the current ratio as well as a related metric, the quick ratio, to measure a company’s liquidity and ability to meet its short-term obligations. If revenue declines and the company experiences negative cash flow as a result, it will draw down its working capital. Investing in increased production may also result in a decrease in working capital. Like liquidity management, managing short-term financing should also focus on making sure that the company possesses enough liquidity to finance short-term operations without taking on excessive risk.

I filed the matter in court, it was later reffered for Arbitration, the tribunal has awarded me working capital and interest. That the award issued by the arbitrator is in conflict with public policy of kenya. The arbitrator maitains that the upshot of this is that the respondent is not a stranger to the claimants claim that it engaged other persons and entities who became his creditors in the execution of the respondents project. The arbitrator find that the claimants claim for the overdraft facilities and the interest accrued on those facilities in the sum of ksh… is merited and i award the same. The sum of kshs… shall attract simple interest at the rate of …% per annum from …..until payment in full. This daily generation of capital should be sufficient enough to meet the cost of business operations on any given day as well as to be able to pay off the debt obligations on any given day.

As such, advance planning of working capital is absolutely necessary on a continuous basis in these cases. In the later case, however, the firms must have to concentrate for manufacturing varied products when there is offseason for the original product. In other words, in order to utilize the physical resource and working force, this policy is quite justified although a greater amount characteristics of working capital of working capital is required for the purpose. The requirements of working capital of a firm are largely affected by the seasonal and cyclical fluctuations which have a direct impact, particularly on the temporary working capital. The firms which are seasonal in character in their business need a large amount of working capital for holding inventory during the peak period.

The inventory turnover ratio indicates how many times inventory is sold and replenished during a specific period. It’s calculated as cost of goods sold divided by the average value of inventory during the period. For example, a retailer may generate 70% of its revenue in November and December — but it needs to cover expenses, such as rent and payroll, all year. Positive working capital means the company can pay its bills and invest to spur business growth.

Essentially, based on the lowest amount of net working capital as per one financial year. This level is considered the permanent or fixed working capital and signifies the minimum investment you must make towards your company’s working capital. If you notice a shortfall, you can finance it using funds from a working capital loan. Those needs can include costs such as payroll, rent, and debt payments. In this way, working capital loans are simply corporate debt borrowings that are used by a company to finance its daily operations.

On the contrary, if the said profit is not distributed by way of dividend but retained, no doubt, the working capital position will improve. Thus, whether the profit shall be retained or distributed depends upon some factors which are to be carefully studied by the financial manager. Retention in the garb of free or General Reserve and/or credit balance of Profit and Loss Account may also become a source of working capital for an established company.

Private and Public equity is generally available in the form of shares. When a company lists itself on the public market exchange, its public equity capital is raised. To obtain debt capital, an individual or a company must have an active credit history. Debt capital is then required to be paid at regular intervals with added interest. The interest rates vary based on the borrower’s credit history as well as the type of capital obtained. Therefore, Capital needs to be reproduced and replenished from time to time.

Current liabilities are those which are repayable or liquidated within a short period of time by the use of the existing resources of current assets or by the creation of similar current liabilities. The short-period concerned is used to refer to a period not exceeding one year from the Balance Sheet date. Trading capital can come from a variety of sources, such as loans from financial institutions or the sale of equity in the company. Special working capital is that part of the variable working capital which is meant for meeting the special business operations such as extensive marketing campaigns, experiments with products or methods of production, etc.

So, the companies use the money from capital funds to advertise these products. Trade Capital is held by firms and individuals that trade on a large scale daily. Trade capital is the amount of money allotted to buy and sell various securities.

This increases current assets by adding to the company’s available cash but doesn’t overly increase current liabilities. In contrast, a company has negative working capital if it doesn’t have enough current assets to cover its short-term financial obligations. A company with negative working capital may have trouble paying suppliers and creditors and difficulty raising funds to drive business growth. If the situation continues, it may eventually be forced to shut down. Therefore, when this policy is followed by a firm along with other symptoms, it may be assumed that the firm is going to be a ‘sick’ one.

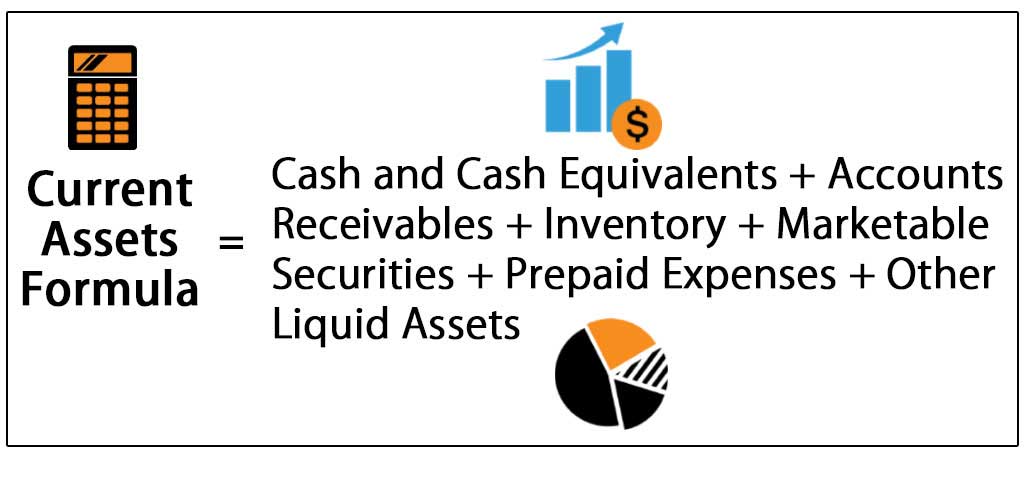

Under the Income-Tax Act, firms are liable to pay income-tax on the assessable net profit as per rates prescribed for the same by Finance Act from time to time. As such, once the net profit of a firm has been ascertained, it makes provisions out of the said profit for payment of Income-tax. Another method of procuring the finance to meet the requirement of short-term or seasonal working capital is public deposits. A company can improve its working capital by increasing its current assets. This included cash, cash equivalents, short-term investments, accounts receivable, inventory, and other current assets.

Working capital represents the cash required by an entity to fund its activities of converting raw materials to completed goods. A company can also improve working capital by reducing its short-term debts. The company can avoid taking on debt when unnecessary or expensive, and the company can strive to get the best credit terms available. The company can be mindful of spending both externally to vendors and internally with what staff they have on hand. Accounts receivable balances may lose value if a top customer files for bankruptcy. Therefore, a company’s working capital may change simply based on forces outside of its control.

In fact, capital accumulation is the very core of economic development. It may be free enterprise economy like the American or a socialist economy like that of Soviet Russia or a planned and mixed economy of India, economic development cannot take place without capital formation. With the growth of technology and specialization, capital has become still more important. In fact, greater productivity of the modern economy likes that of the U.S.A. is mainly due to the extensive use of capital, i.e., machinery, tools or implements in the productive process.

Working capital fails to consider the specific types of underlying accounts. For example, imagine a company whose current assets are 100% in accounts receivable. Though the company may have positive working capital, its financial health depends on whether its customers will pay and whether the business can come up with short-term cash. Net working capital is the difference between your company’s current assets and current liabilities as per its balance sheet. It can be further divided into positive net working capital and negative net working capital.

Only learning the factors that determine the requirement of working capital does not solve the whole problem of working capital. Management should also estimate the working capital requirement in monetary terms. Obviously, a growing industry increases the requirement of working capital also as compared to a static industry.

It is considered to be the life-blood of the business and its effective and efficient management is necessary for the very survival of the business. Trade DiscountsThe reduction in list price allowed by a supplier to the consumer while selling the product in bulk quantities is referred to as a trade discount. Working Capital is the lifeline of a business and enables the smooth running of the business’s day-to-day operations. Each component is essential and plays an indispensable role in ensuring the success and smooth running of the business.