0x1c8c5b6a

- 15 de junio de 2025

- Sin categorizar

0x1c8c5b6a

Leer másContents

The bounce ended when prices moved back below the Base Line to trigger the bearish signal. There are two ways to identify the overall trend using the cloud. First, the trend is up when prices are above the cloud, down when prices are below the cloud and flat when prices are in the cloud. Second, the uptrend is strengthened when the Leading Span A is rising and above the Leading Span B .

Its function is to inform us about the long-term volatility of the price and directly reflects the price. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We tickmill forex broker introduction also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. If you are looking to trade forex online, you will need an account with a forex broker.

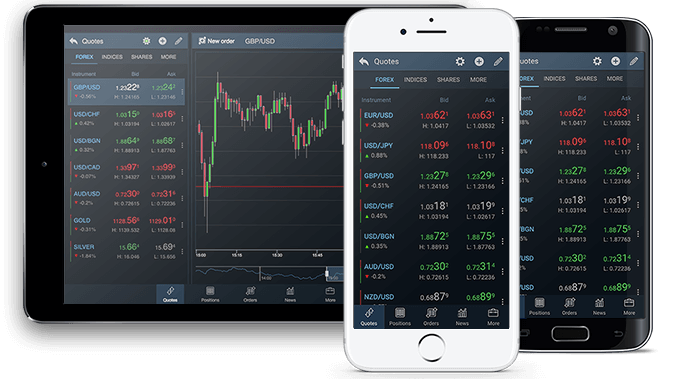

Find out which are the best settings to use for this indicator in the MetaTrader 4 trading platform, and follow step-by-step tutorials that will guide you through each scenario. More than a broker, Admirals is a financial hub, offering a wide range of financial products and services. We make it possible to approach personal finance through an all-in-one solution for investing, spending, and managing money. You’ll surely find it useful to install the MetaTrader Supreme Edition plugin and substantially expand your armoury of trading tools. MTSE is a custom plugin for MetaTrader 4 and MetaTrader 5 that has been carefully put together by market professionals to provide a cutting-edge trading experience. The signal will be on the side of the buyers if the Chikou Span line is above the current price.

If the faster line breaks the slow line from below, the probability of a bearish trend is high. Otherwise, we should expect the formation of a bullish trend. Based on how the Ichimoku lines are located, you can identify the vector and strength of the trend.

Basically, old Kijun-Sen / Tenkan-Sen / Senkou-Span A / Senkou-Span B levels can still be relevant, and keeping an eye on the Chikou Span will make you keep those levels in mind. The Ichimoku Cloud is a comprehensive indicator designed to produce clear signals. Chartists can first determine the trend by using the cloud. Once the trend is established, appropriate signals can be determined using the price plot, Conversion Line, and Base Line.

From basic trading terms to trading jargon, you can find the explanation for a long list of trading terms here. Gordon Scott has been an active investor and technical analyst or 20+ years.

When the price enters the cloud below, you can look for the possibility of opening a long transaction. If the price penetrates the cloud from above, you may consider a short position. When the price is above the cloud, this means that the pair is always in an uptrend. If it is below the cloud, this means that the pair is in an downtrend. This strategy can help to give the trader a good understanding of the market and trends.

When functioning as an additional confirmation, some traders only trade when the delay line shows that there is an opportunity. They wait patiently for this strategy to confirm the signals. This is a special line, since it confirms any current trends with greater reliability than when comparing the price with the cloud, like in the first strategy. The Chikou span or delay line can be used to determine the strength of the buy or sell signal. The kumo, or cloud, is the space bounded between the Senkou span A and the Senkou span B.

This is the midpoint between the Conversion Line and the Base Line. It is referred to as “Leading” because it is plotted 26 periods in the future and forms the faster cloud boundary. On a daily chart, this line is the midpoint of the 26-day https://traderoom.info/ high-low range, which is almost one month). If the price in the cloud area, you may talk of the formation of a sustainable trade corridor, in which either its borders or inside Kijun-sen or Tenkan-sen can be the pre-emptive lines.

It gives you insight about potential current and future support / resistance levels and gives you immediate insight about the trend of the underlying asset you’re using it on. It can also be used as an indicator, giving you overbought / oversold signals, showing you potential trend changes and it can give you confluence with your own support / resistance levels. In the end it’s up to each individual on how they chose to use the Ichimoku Kinko Hyo. As mentioned above, these two indicators act as a moving average crossover, with the Tenkan representing a short-term moving average and the Kijun acting as the baseline. As a result, the Tenkan dips below the Kijun, signaling a decline in price action.

The color of the Kumo shading depends on which line is on top. If it’s Senkou Span A, then the cloud is usually red, if Senkou Span B, then it is blue. It is to be recalled that these lines perfectly show the location of the levels of dynamic resistance or support, which is perhaps the most important for many users of the Ichimoku indicator. The first signal is based on the fact that the Chinkou Span line represents the current price, which is offset by several periods.

This is a confirmation line, a support/resistance line, and can be used as a trailing stop line. The Kijun Sen acts as an indicator of future price movement. If the price is higher than the blue line, it could continue to climb higher. If the price is below the naga broker blue line, it could keep dropping. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey.

If we open a long trade using the line crossing strategy , we will get an exit signal from this long position when these 2 lines cross once again, but in the opposite direction. It is a bearish sign, and the bottom of the cloud acts as the first level of resistance. Logically, the top of the cloud is the second level of resistance.

Price starts pumping from there and tries to travel through the cloud. Price corrects inside the cloud but stays above the Tenkan / Kijun, both on the daily as on the 12h, so it’s still bullish. You stay in the trade even though price dropped back out of the daily cloud. Kumo Twists happen when the Senkou-Span A and the Senkou-Span B cross.

Seeing the breakout, you should open up after it, as quickly as possible, of course without forgetting the classical safety points. Tenkan-sen is a reversal line indicating the presence and direction of a short-term trend. It is calculated similarly with Kijun-sen – the sum of the maximum and minimum price for the selected period is divided by two. Ichimoku Kinko Hyo is the Ichimoku indicator that can be used to analyze price charts at any time intervals. This is a combination of five lines, three of which are completely independent, and two are linked together, forming a separate area. Before talking about Ichimoku signals, let’s look at these elements closer, not to get confused with the titles and essence of the Ichimoku lines.

Price, the Conversion Line and the Base Line are used to identify faster and more frequent signals. It is important to remember that bullish signals are reinforced when prices are above the cloud and the cloud is green. Bearish signals are reinforced when prices are below the cloud and the cloud is red. In other words, bullish signals are preferred when the bigger trend is up , while bearish signals are preferred when the bigger trend is down .

Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. This behavior can also be considered as the beginning of an uptrend, and the end of a bearish steak. This is because the direction of the Tenkan-sen line can suggest if the market is trending or not. A rising Tenkan-sen suggests an upward trend, and a falling line represents a downward one. As the line is calculated from price extremes, it will tend to flatten out when the market is not trending.

If it is above the chart of price, it means that current prices are higher than previous ones. The interaction of Tenkan-sen to Kijun-sen can give us trading signals, in a similar fashion to a moving average crossover. That is to say, if the fast-moving Tenkan-sen crosses above the slower-moving Kijun-sen, it can be a signal to buy.

This indicator is now used by many Japanese trading rooms because it offers multiple tests on the price action, creating higher probability trades. Although many traders are intimidated by the abundance of lines drawn when the chart is actually applied, the components can be easily translated into more commonly accepted indicators. This article features four bullish and four bearish signals derived from the Ichimoku Cloud plots. The trend-following signals focus on the cloud, while the momentum signals focus on the Conversion and Base Lines. In general, movements above or below the cloud define the overall trend. Within that trend, the cloud changes color as the trend ebbs and flows.